2016

Prices Available on Website

Cleo

The A.I Assisstant for Your Money

Video & Screenshots

Overview

Overview

Features

Features

- Personal finance management: Cleo allows users to manage their personal finances by tracking their spending, creating budgets, and setting financial goals. This feature helps users to stay on top of their finances and make informed financial decisions.

- Bill tracking: Cleo can track and manage bills for its users, including sending reminders when bills are due and tracking payment history. This feature helps users to avoid late payments and potential fees.

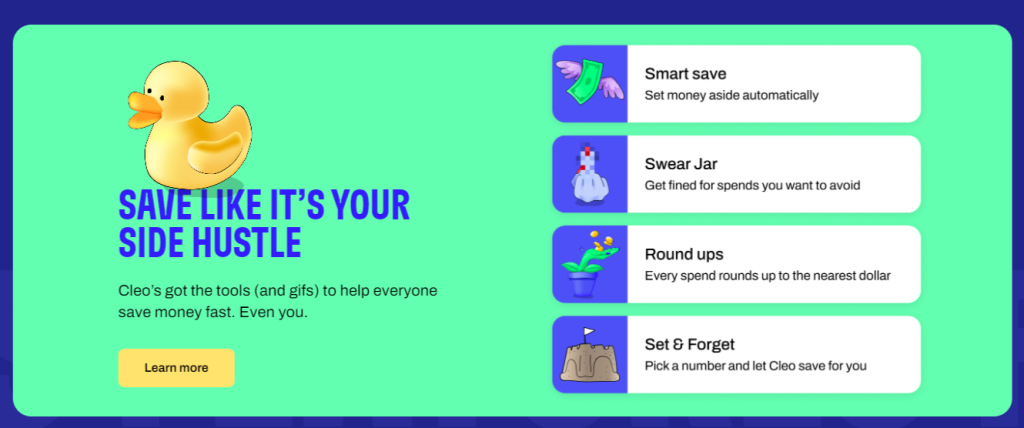

- Automated savings: Cleo’s automated savings feature helps users save money by analyzing their spending patterns and automatically transferring a designated amount to their savings account. This feature helps users to build savings without having to think about it.

- Investment options: Cleo offers investment options through its partner platforms, allowing users to invest their savings directly from the app. This feature helps users to grow their wealth over time.

- AI-powered chatbot: Cleo’s chatbot is powered by artificial intelligence and can answer users’ questions about their finances, provide personalized financial advice, and even help users find deals on products and services.

- Real-time transaction tracking: Cleo tracks users’ transactions in real-time, allowing them to see where their money is going and identify any fraudulent activity.

- Cashback rewards: Cleo offers cashback rewards to its users for making purchases with certain partner merchants. This feature allows users to earn rewards for their spending.

- Multi-currency account: Cleo offers a multi-currency account that allows users to hold and spend money in multiple currencies without incurring fees. This feature is especially useful for frequent travelers or those who have international financial obligations.

- Easy budget creation: Cleo makes it easy for users to create and stick to a budget by offering pre-made budget templates and providing insights into spending habits.

- Bank-level security: Cleo uses bank-level security measures to protect its users’ personal and financial information, including 256-bit SSL encryption and two-factor authentication.