2016

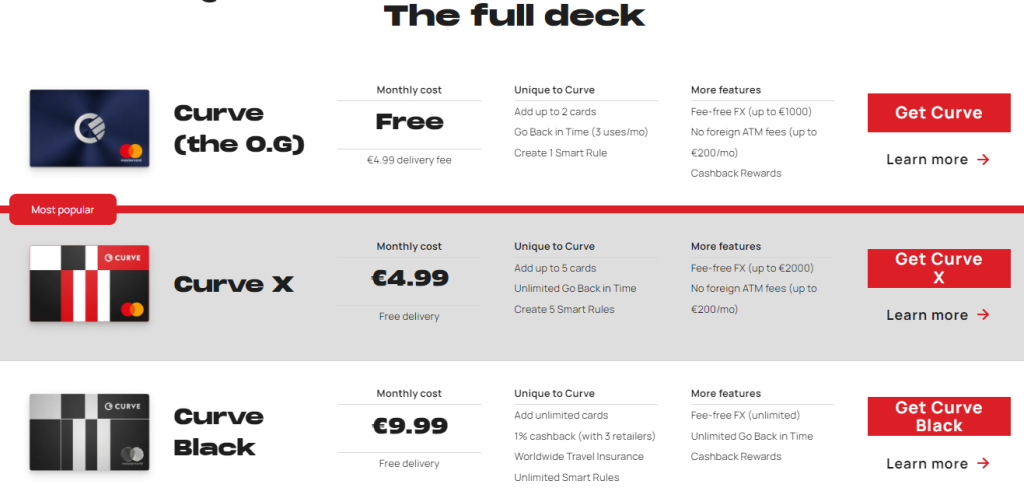

Prices Available On Website

Curve

All Your Cards, Rewards & Cashback in One

Video & Screenshots

Overview

Overview

Features

Features

- All-in-one banking: Curve offers a one-stop-shop for all your banking needs, including budgeting, spending, and saving, with the added benefit of a mobile wallet. This feature is perfect for those who want to simplify their finances and streamline their spending.

- Real-time notifications: With Curve, you receive instant notifications for all your transactions, including online and offline purchases. This feature is useful for tracking your spending and detecting any fraudulent activities in real-time.

- Go-Back-In-Time: Curve’s “Go-Back-In-Time” feature allows you to switch the card you used for a transaction up to 90 days after the purchase. This feature is beneficial if you have used the wrong card or if you want to switch to a card that offers more rewards.

- Cashback rewards: Curve offers cashback rewards on your purchases at selected retailers. This feature is perfect for those who want to save money on their everyday expenses.

- Travel benefits: With Curve, you can avoid foreign transaction fees when traveling abroad, and you can also earn travel points with selected partners. This feature is beneficial for those who frequently travel and want to save money on transaction fees.

- Contactless payments: Curve supports contactless payments, making it easy to pay for your purchases with just a tap of your phone or card. This feature is perfect for those who prefer a fast and convenient payment method.

- Security features: Curve uses advanced security features, such as 3D secure and two-factor authentication, to protect your account from fraud. This feature is important for those who want to ensure the safety of their financial information.

- Multi-currency support: With Curve, you can hold multiple currencies in one account and easily switch between them, making it easy to manage your international transactions. This feature is perfect for those who frequently do business internationally.

- Business expense management: Curve offers features to help businesses manage their expenses, such as expense reports and virtual cards for employees. This feature is beneficial for small businesses and startups.

- Intuitive user interface: Curve’s user interface is user-friendly and easy to navigate, making it easy for users to manage their finances. This feature is beneficial for those who are new to mobile banking and want a simple and intuitive experience.