2016

Prices Avaible on Website

Novo

All your Business Banking in one platform

Video & Screenshots

Overview

Overview

Features

Features

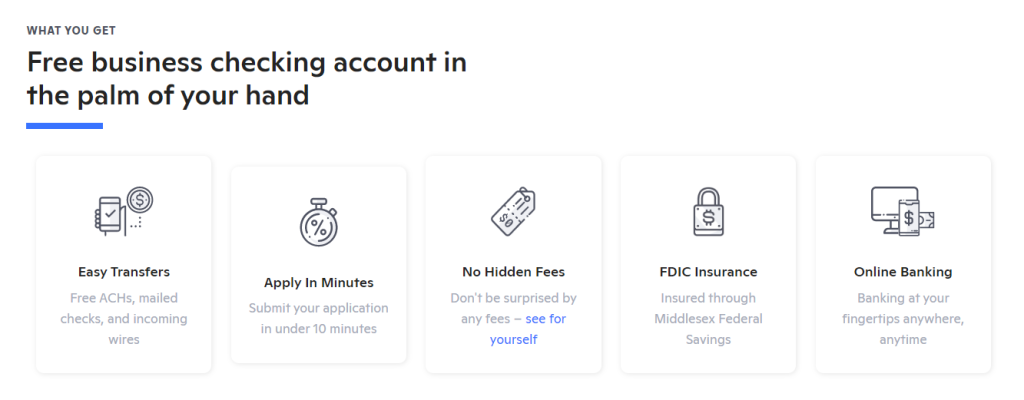

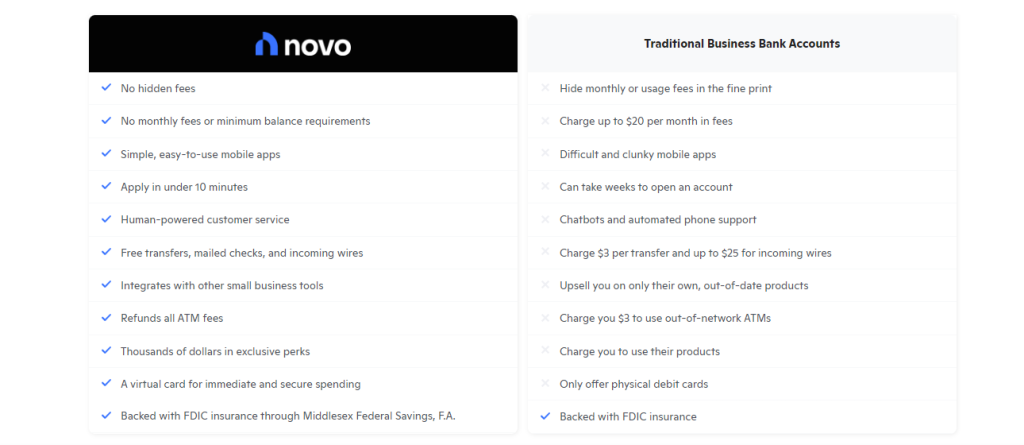

- No Monthly Fees: Novo does not charge any monthly fees for their business banking services, making it an affordable option for small businesses and startups.

- Easy Account Opening: Novo allows users to open a business account within minutes through their mobile app, without the need for visiting a physical branch.

- Unlimited Transactions: With Novo, businesses can make unlimited transactions without any extra charges.

- Integration with Accounting Software: Novo integrates with popular accounting software like QuickBooks, Xero, and Wave, making it easier for businesses to manage their finances.

- Mobile Banking: Novo’s mobile app allows users to manage their accounts, make payments, and deposit checks from their mobile devices.

- Business Debit Card: Novo offers a free business debit card that can be used for purchases and ATM withdrawals.

- 24/7 Customer Support: Novo provides 24/7 customer support to assist businesses with their banking needs.

- ACH and Wire Transfers: Novo enables businesses to make ACH and wire transfers for payroll and other business expenses.

- FDIC-Insured: Novo accounts are FDIC-insured up to $250,000, providing businesses with added security.

- Cash Deposit Services: Novo partners with Green Dot to provide cash deposit services at over 90,000 locations across the US.