2014

Prices Available on Website

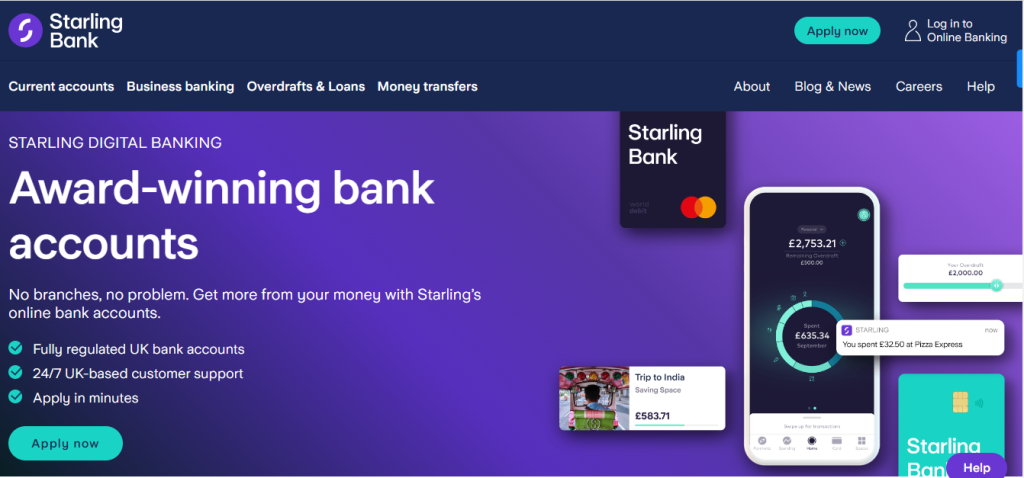

Starling Bank

Personal and Business Banking, at your Fingertips

Video & Screenshots

Overview

Overview

Features

Features

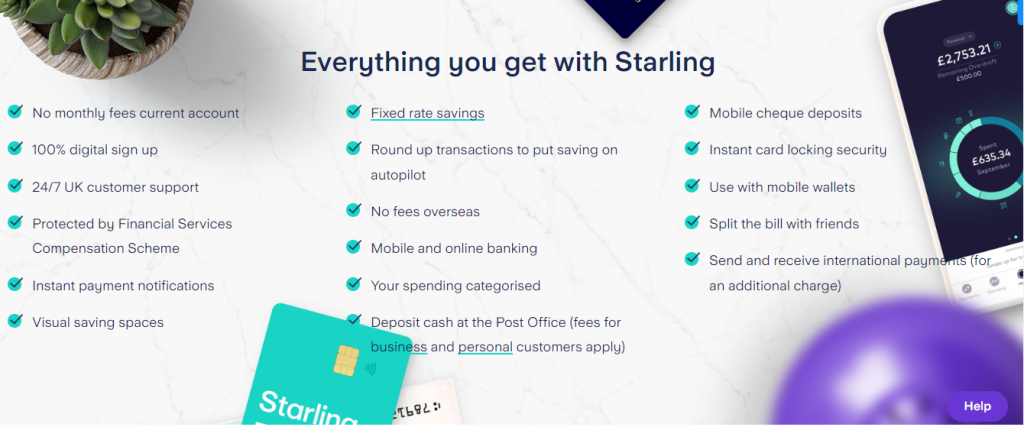

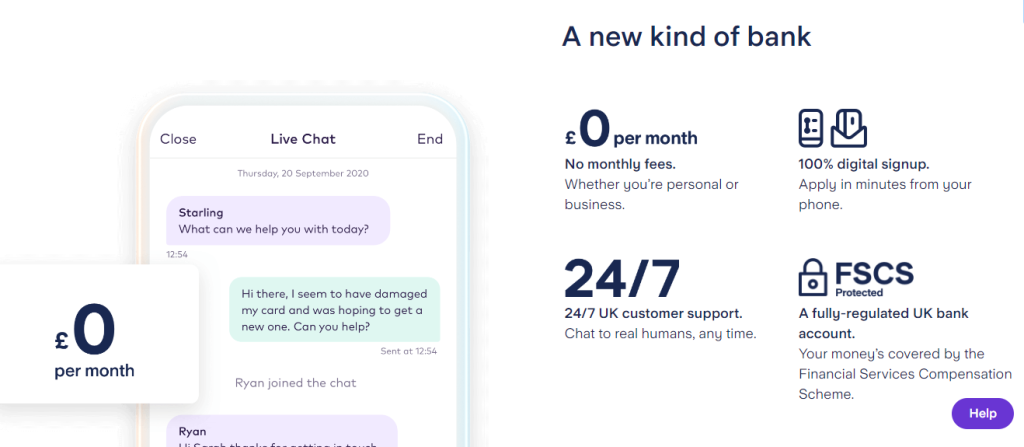

- Mobile-first banking: With Starling Bank, you can manage your finances directly from your mobile device. The user-friendly app allows you to check your account balances, make payments, and monitor your spending in real-time.

- Fee-free spending abroad: Starling Bank doesn’t charge any fees for spending abroad, making it an ideal choice for frequent travelers.

- Instant notifications: Receive instant push notifications for all transactions and account activity, allowing you to stay on top of your finances.

- Categorization of spending: The app automatically categorizes your spending, helping you to better understand where your money is going and enabling you to make informed financial decisions.

- Budgeting tools: Starling Bank provides a range of budgeting tools, such as the ability to set spending limits and create savings goals. These features help you to take control of your finances and stay on track with your financial goals.

- Advanced security measures: Starling Bank utilizes the latest security technologies, such as two-factor authentication and biometric identification, to ensure that your money is safe and secure.

- Business banking services: In addition to personal banking solutions, Starling Bank offers a range of specialized services for businesses, including business accounts, loans, and overdrafts.

- 24/7 support: Starling Bank’s award-winning customer service team is available around the clock to assist you with any questions or concerns you may have.

- Open Banking integrations: With Open Banking integrations, you can connect your Starling Bank account to other financial services and apps, such as budgeting tools and investment platforms.

By offering a mobile-first approach, fee-free spending abroad, budgeting tools, and other innovative features, Starling Bank is transforming the banking industry and providing customers with a modern and convenient way to manage their finances.